Giving Ventures Podcast: Episode 88 – The Traditionalist Conservatives

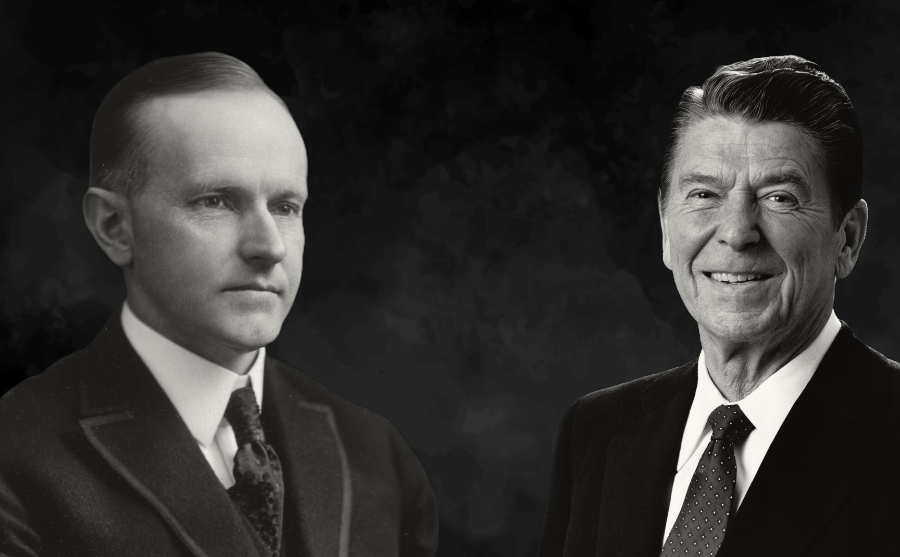

In the fourth installment of our summer series on "What Is the Right?," Peter explores…

DonorsTrustJune 24, 2025